The Future of Wealth: Investing in Emerging Technologies & Industries

Key Takeaways

- Stay informed about emerging technologies like AI, blockchain, and renewable energy, as they are reshaping wealth management and investment opportunities, including digital investments and fintech solutions, in this digital revolution for financial advisors.

- Diversify your portfolio for future wealth management by including investments in new industries, which can offer high growth potential and mitigate risks in the wealth management sector.

- Consider sustainable investing strategies that focus on companies with positive environmental and social impacts, utilizing wealth management platforms and tech for portfolio management, aligning your investments with your values in the wealth industry.

- Communicate effectively with financial advisors in the wealth industry to understand the implications of new technologies on your investments in this age and to tailor strategies that fit your goals.

- Regularly review and adjust your investment strategy to adapt to the fast-paced changes in technology and market demands of this age.

- Leverage data, tech, and analytics to make informed decisions about where to invest, ensuring that you are capitalizing on trends before they become mainstream.

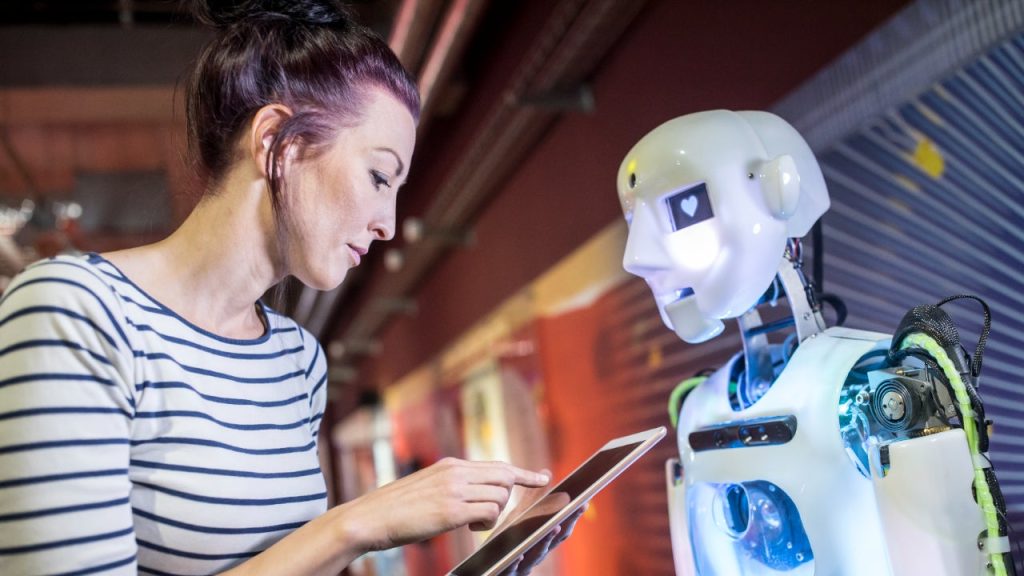

The Impact of Emerging Technologies on Wealth Management

New Trends

Wealth management is changing. New wealth management technology trends are reshaping how services are delivered. Digital platforms now offer clients more control over their investments in this tech age. This shift improves client engagement with tech and helps wealth managers respond quickly to market changes.

AI and Blockchain

Technologies like AI and blockchain play a crucial role. They help tackle modern financial complexities. AI analyzes vast amounts of data in this tech age, providing insights for better decision-making. Blockchain tech ensures secure transactions, increasing trust between clients and managers. These tools enhance the overall wealth management landscape.

Data Accuracy

Data accuracy is vital in wealth management. Advanced technologies provide precise information. This leads to faster decisions and improved service quality. Wealth managers can now offer personalized wealth management solutions tailored to individual client needs using tech.

Effective Services

Emerging technologies enable effective wealth management services. Clients expect seamless experiences from their wealth management platforms. Companies that embrace these technologies in this age will likely lead the market. Successful wealth managers leverage tech and these tools to provide complete wealth management solutions that meet client demands.

Future Outlook

The future of wealth management looks promising with technology at its core. As the industry evolves, staying updated on these trends becomes essential for both clients and managers. Those who adapt will thrive in this new environment.

Key Emerging Technologies to Watch

AI and Machine Learning

Investors should monitor AI and machine learning closely. These technologies are reshaping investment strategies. They help in asset management by analyzing large datasets quickly. This can lead to more informed decisions. Firms use predictive analytics to assess market trends. This evolution allows for better risk management and portfolio optimization.

Blockchain Technology

Blockchain technology is revolutionizing how financial transactions are recorded. It enhances cybersecurity by providing a secure, transparent way to track assets age. Each transaction is encrypted and linked to previous ones, making fraud difficult with age. Financial institutions are increasingly adopting blockchain for its efficiency. This trend indicates a shift towards more secure banking practices in this age.

Wealthtech Solutions

Wealthtech solutions streamline workflows for financial advisors. These tools improve financial planning processes significantly. They integrate various data sources into one platform, enhancing the digital ecosystem of wealth management. Advisors can offer personalized services based on real-time data analytics, considering age. This helps clients make better investment choices and manage their wealth effectively.

Investment Strategies for New Technologies

Diversifying Portfolios

Investors should diversify portfolios to include high-potential emerging technologies of this age. This approach reduces risk while maximizing returns. Investing in sectors like fintech, renewable energy, and artificial intelligence in this age can yield significant benefits. Each technology brings unique opportunities and challenges. A well-rounded portfolio balances these factors.

Assessing Risk and Return

Assessing risk and return profiles is crucial for tech investments at any age. Investors must analyze the volatility of new technologies. For instance, age blockchain projects may offer high returns but also come with high risks. Understanding market trends helps investors make informed decisions. Regular reviews of investment performance at any age ensure alignment with financial goals.

Leveraging Advanced Algorithms

Investors can leverage advanced algorithms for dynamic asset allocation and rebalancing. These tools analyze vast amounts of data quickly. They help identify trends and adjust portfolios accordingly. Using algorithms enhances decision-making in fast-paced markets. It allows for more precise financial planning tools that adapt to changing conditions with age.

Sustainability in Tech Investments

Environmental Focus

Investments should prioritize technologies that enhance environmental sustainability. Companies developing renewable energy sources and waste reduction methods in this age are crucial. These firms often create solutions that lower carbon footprints. Investing in such technologies can lead to a healthier planet in this age.

Social Impact

Evaluating the long-term impact of tech investments in this age is essential. Consider how these investments affect social structures, age, and economic growth. For instance, companies that improve connectivity can bridge gaps in education and healthcare in this age. This leads to stronger communities and better quality of life.

Governance Practices

Support companies with strong ESG practices. Firms that adhere to regulatory compliance show commitment to ethical standards. They often have better risk management strategies, which can protect investments during market fluctuations. Investors should look for businesses that promote transparency and accountability.

Ecosystem Development

Investing in an ecosystem of sustainable technologies fosters innovation. Collaborations between startups, governments, and established firms create a vibrant marketplace. This dynamic environment encourages the development of new solutions for pressing challenges.

Effective Communication in Modern Investing

Digital Platforms

Digital platforms revolutionize how financial advisors connect with clients. They allow for personalized investment advice tailored to individual needs. Through these platforms, advisors can share timely information and updates about market trends. This enhances transparency and builds trust.

Social Media Engagement

ial media plays a crucial role in enhancing client relationships. Financial advisors use these channels to engage clients directly. They share insights, answer questions, and provide educational content. This approach increases client satisfaction and fosters a sense of community.

Robo-Advisors

Robo-advisors offer automated financial planning services. These tools use algorithms to create investment strategies based on user data. They provide efficient management of portfolios at lower costs. Clients benefit from quick decision-making without sacrificing accuracy.

Compliance and Volatility

Effective communication also addresses compliance issues. Financial advisors must ensure that all interactions meet regulatory standards. Clear communication helps clients understand the risks associated with market volatility. This transparency is vital for informed decision-making.

Relationship Building

Building strong relationships remains essential in investment management. Advisors who prioritize open lines of communication foster loyalty among clients. Regular updates and check-ins keep clients informed and engaged.

Closing Thoughts

The future of wealth lies in your hands. Investing in emerging technologies and industries is not just a trend; it’s a necessity. By understanding the impact of these technologies, you can position yourself for success. Keep an eye on key innovations and adopt smart investment strategies that align with sustainability. Effective communication will also empower you to make informed decisions.

Now’s the time to act. Don’t wait for others to seize these opportunities. Dive into the world of tech investments, stay updated, and engage with experts in the field. Your financial future depends on it. Start exploring today and unlock new possibilities for growth and wealth creation.

Frequently Asked Questions

What are emerging technologies in wealth management?

Emerging technologies in wealth management include AI, blockchain, and fintech innovations. These tools enhance efficiency, improve client experiences, and offer new investment opportunities.

How do I identify key emerging technologies to invest in?

Research industry reports, follow tech news, and consult expert analyses. Focus on sectors with rapid growth potential, such as renewable energy, AI, and biotechnology.

What investment strategies work best for new technologies?

Diversification is key. Consider investing in ETFs or mutual funds focused on technology sectors. Also, evaluate individual startups with strong leadership and innovative solutions.

How does sustainability affect tech investments?

Sustainable tech investments focus on environmental impact and social responsibility. Companies prioritizing sustainability often attract more investors and can lead to long-term profitability.

Why is effective communication important in modern investing?

Effective communication builds trust between investors and advisors. Clear dialogue ensures that clients understand their options and feel confident in their investment choices.

What role does research play in investing in emerging technologies?

Thorough research helps investors assess risks and opportunities. Understanding market trends, company performance, and technological advancements informs better decision-making.

How can I stay updated on emerging technologies?

Subscribe to industry newsletters, attend webinars, and follow thought leaders on social media. Staying informed enables you to make timely investment decisions.

Send Buck a voice message!

Send Buck a voice message!