Decentralized Autonomous Corporations: The Next Frontier in Business

Decentralized autonomous corporations (DACs) are changing the game in business. These innovative structures allow for transparency, efficiency, and community-driven decision-making. Imagine investing in an organisation where every shareholder has a voice and profits are shared fairly in the organization.

Investing in DACs means diving into the future of business organization. They offer unique opportunities for growth and collaboration that traditional companies can’t match. With blockchain technology at their core, DACs promise security and decentralization. This post will explore how investing in DACs can reshape your financial future and why they’re worth considering now.

Key Takeaways

- Decentralized Autonomous Corporations (DACs) are changing how businesses operate by using blockchain technology to enhance transparency and efficiency.

- Investors should explore DACs as they offer unique investment opportunities that can lead to significant returns, especially in emerging markets.

- Understanding the benefits and challenges of DACs is crucial; they provide innovative solutions but also face regulatory hurdles and governance issues.

- Real-world examples, like successful DAC implementations, illustrate how these structures can disrupt traditional business models and drive growth.

- Staying informed about future trends in DACs can help investors make better decisions and adapt to the evolving landscape of business.

- Engaging with communities around DACs can provide valuable insights and networking opportunities for those looking to invest or participate in this innovative sector.

Understanding Decentralized Autonomous Corporations

Definition of DACs

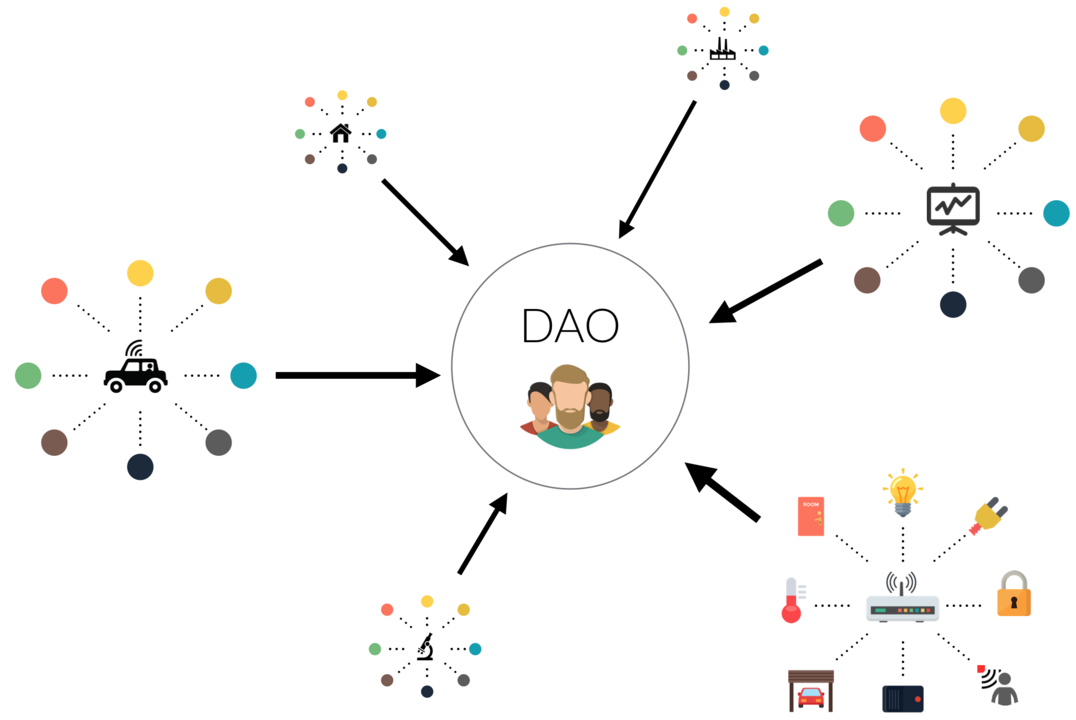

Decentralized autonomous corporations (DACs) are organizations that operate without a central authority. They rely on blockchain technology to manage operations. These entities are often confused with decentralized autonomous organizations (DAOs). However, DACs focus more on business functions, while DAOs emphasize governance and community decision-making.

DACs use smart contracts to automate various processes. Smart contracts are self-executing agreements coded on the blockchain. They execute actions when specific conditions are met. This automation reduces the need for human intervention in daily operations.

Role of Smart Contracts

Smart contracts play a crucial role in decentralized autonomous corporations. They ensure transparency and security in transactions. When a condition is satisfied, the smart contract automatically triggers an action. For example, if a customer pays for a product, the smart contract releases the product to the customer without delay.

This automation enhances efficiency within DACs. It minimizes errors that can occur with manual processing. It speeds up transactions, making businesses more agile. Companies can respond quickly to market changes and customer demands.

Management Differences

Decentralized autonomous corporations differ significantly from traditional corporations. Traditional companies have a hierarchical structure with clear management roles. Decisions often come from executives or board members. In contrast, DACs operate on a flat structure where stakeholders influence decisions collectively.

In DACs, every member has a voice in decision-making processes. Voting mechanisms allow participants to propose changes or vote on important issues. This democratic approach fosters a sense of ownership among members.

Moreover, profits in DACs can be distributed differently compared to traditional firms. Instead of dividends paid to shareholders, profits may go directly to members based on their contributions or participation levels.

Advantages of DACs

- Transparency: All transactions are recorded on the blockchain.

- Reduced Costs: Automation lowers operational costs.

- Global Reach: Anyone with internet access can participate.

- Flexibility: Quick adaptation to market trends.

Challenges Facing DACs

- Regulatory Uncertainty: Laws around DACs are still developing.

- Technical Risks: Vulnerabilities in smart contracts can lead to losses.

- Coordination Issues: Decision-making can become slow without clear leadership.

The Evolution of Business Structures

Historical Development

Business structures have undergone significant evolution over the years. Early organizations relied on simple hierarchies. These systems were often rigid and slow to adapt. The Industrial Revolution in the 18th century marked a turning point. Factories emerged, leading to larger organizations. This era introduced formal management roles and bureaucratic processes.

In the late 20th century, globalization changed how businesses operated. Companies became more interconnected. Technology began to play a crucial role in this transformation. The rise of the internet allowed for faster communication and collaboration. Businesses started adopting more flexible structures, adapting to market demands quickly.

Impact of Technology

Technology has dramatically influenced business models. The introduction of blockchain technology in 2008 changed everything. Blockchain allows for secure transactions without intermediaries. This innovation created new opportunities for decentralized systems.

Smart contracts are another breakthrough. These clever contracts automate agreements between parties. They execute automatically when conditions are met. This reduces the need for trust and oversight, streamlining operations.

The combination of blockchain and smart contracts enables decentralized autonomous corporations (DACs) to thrive. DACs operate on predefined protocols, allowing for self-management. They do not rely on traditional management hierarchies.

Key Factors Driving Change

Several key factors drive the shift towards decentralized business structures. First, there is a growing demand for transparency in organizations. Stakeholders want to see how decisions are made and funds are allocated. Blockchain technology provides this transparency through its public ledger system.

Second, many people seek greater control over their investments and contributions. Traditional corporations often limit individual agency within their structures. DACs empower participants by giving them a voice in decision-making processes.

Lastly, the global economy is pushing for more efficient systems. Centralized organizations can be slow and bureaucratic. Decentralized mechanisms allow for quicker responses to market changes.

Investors are increasingly attracted to these new forms of organization. They see potential in decentralized models that promise efficiency and transparency. As more people understand the benefits of DACs, interest continues to grow.

Benefits and Challenges of DACs

Increased Transparency

DACs offer increased transparency in their operations. All transactions are recorded on a blockchain. This makes it easy for anyone to verify actions taken by the corporation. With traditional companies, information can be hidden or manipulated. In contrast, DACs provide clear visibility into financial activities and decision-making processes.

Stakeholders can track how resources are allocated. They can see decisions made and understand the rationale behind them. This openness builds trust among investors and participants. It encourages greater involvement in the governance of the organization.

Reduced Operational Costs

Operational costs often decrease in DACs. Automation handles many tasks that require human intervention in traditional businesses. Smart contracts execute agreements without needing intermediaries. This reduces fees associated with legal and administrative processes.

Fewer employees may be necessary to manage operations. Organizations can allocate funds more efficiently. These savings can then be reinvested into growth or distributed among stakeholders.

Regulatory Hurdles

Challenges exist alongside these benefits. Regulatory hurdles pose a significant issue for DACs. Many governments have not established clear rules for these organizations. This uncertainty can deter potential investors who fear legal repercussions.

Different countries have varying regulations regarding cryptocurrencies and blockchain technology. Some nations embrace DACs while others impose strict controls or outright bans. Navigating this landscape requires careful planning and legal expertise.

Technological Limitations

Technological limitations also present challenges. The infrastructure supporting DACs must be robust and secure. Vulnerabilities could lead to hacks or data breaches, undermining trust in the system.

Moreover, not all users may have access to the necessary technology or understanding to participate effectively. This can create barriers between different groups of people, limiting inclusivity.

Accountability and Decision-Making

Decentralized governance impacts accountability significantly. In DACs, decision-making lies with the community rather than a single entity. This can lead to more democratic processes, allowing diverse voices to be heard.

However, this structure also raises questions about responsibility. If a decision goes wrong, it may be unclear who is accountable. Traditional corporations usually have designated leaders responsible for outcomes. In DACs, collective responsibility might dilute individual accountability.

The implications of decentralized governance are vast. They challenge conventional business practices while promoting innovative approaches to management.

Governance in Decentralized Corporations

Governance Mechanisms

Decentralized autonomous corporations (DACs) operate under unique governance mechanisms. These systems rely on decentralized governance models that allow for distributed decision-making. Unlike traditional corporations, DACs do not have a central authority. Instead, they utilize smart contracts to automate processes and enforce rules.

Members participate in the governance through tokens. Token holders often vote on key issues, such as funding and project direction. This model fosters a sense of ownership among participants. It also encourages transparency since all actions are recorded on the blockchain. The decentralization of power helps prevent corruption and ensures accountability.

Community Participation

Community involvement plays a crucial role in shaping DAC policies. Each member can voice their opinion and influence decisions directly. This level of participation is vital for creating a responsive organization. The more engaged the community is, the more effectively it can address challenges.

DACs thrive on feedback from their participants. Regular discussions and proposals help refine strategies and initiatives. This collaborative approach leads to better outcomes for all stakeholders. Furthermore, it strengthens the community’s bond and commitment to shared goals.

Consensus Algorithms

Consensus algorithms are essential for maintaining order within DAC governance. These algorithms ensure that all members agree on decisions before they are finalized. They help manage governance complexities by providing clear guidelines for reaching consensus.

Different types of consensus methods exist, such as Proof of Work (PoW) and Proof of Stake (PoS). These systems verify transactions and validate votes in a secure manner. By doing this, they build trust among participants and promote fairness in governance.

The use of consensus algorithms also prevents malicious activities. They create barriers against fraud and manipulation, ensuring that decisions reflect the will of the majority. This reliability is crucial for sustaining long-term investments in decentralized ecosystems.

Decentralized technologies enhance these governance structures further. They offer tools for real-time communication and data sharing among members. This connectivity allows quicker responses to emerging issues or opportunities.

Real-World Examples and Case Studies

Notable DACs

Several decentralized autonomous corporations (DACs) have shown success in their operations. One prominent example is Aragon, launched in 2017. It provides a platform for users to create and manage their own DACs. Aragon enables people to govern organizations without centralized control. Users participate in voting on proposals and decisions through its blockchain technology.

Another successful DAC is DAOstack, introduced in 2018. This platform focuses on decentralized governance and community participation. DAOstack allows individuals to collaborate on projects while maintaining transparency in operations. The use of smart contracts ensures that all procedures are followed correctly.

Industry Applications

DACs have found applications across various industries. In finance, the MakerDAO operates a stablecoin called DAI. This system allows people to borrow against their cryptocurrency holdings. Users participate in governance by voting on changes to the protocol. This model shows how community involvement can enhance financial systems.

In the creative sector, Audius emerged as a music streaming platform using a DAC model. Artists can share their content directly with fans without intermediaries. This approach helps creators receive more revenue from their work. Audius demonstrates how DACs can disrupt traditional business models.

Challenges Faced

Despite their advantages, DACs face challenges. One issue is the need for due diligence among participants. Many individuals may not fully understand the operational models or risks involved. This lack of knowledge can lead to poor decision-making within these organizations.

Security is another concern for DACs. Smart contracts can be vulnerable to hacks if not coded properly. For instance, in 2016, the DAO hack resulted in a loss of $60 million worth of Ether due to security flaws. This incident highlighted the importance of robust development practices.

Lessons Learned

Real-world implementations of DACs provide valuable lessons. First, clear communication is essential among participants. Everyone must understand their roles and responsibilities within the organization.

Second, ongoing education about the technology is crucial. Individuals should learn about blockchain and smart contracts before participating in a DAC. This knowledge helps mitigate risks associated with involvement.

Lastly, adaptability is key for DACs to thrive. They must be prepared to adjust operations based on community feedback and changing market conditions.

Investment Opportunities in DACs

Emerging Trends

Investment in decentralized autonomous corporations (DACs) is on the rise. Many investors are looking for innovative opportunities in this space. The trend shows a growing interest in blockchain technology and smart contracts. These tools enhance transparency and efficiency in business operations.

The market potential for DACs is significant. Reports indicate that the global blockchain market could reach $67.4 billion by 2026. This growth opens doors for new investment avenues within DACs. Investors can tap into various sectors, such as finance, supply chain, and healthcare. Each sector offers unique opportunities for returns.

Governance Structures

Evaluating the governance structure of a DAC is crucial before investing. Each DAC operates differently, with its own rules and decision-making processes. Some use token-based voting systems to involve community members in decisions. Others might rely on a more centralized form of governance.

Community support plays a vital role too. A strong community can drive the success of a DAC. Active participants often contribute to development and marketing efforts. Investors should research community engagement levels before making commitments. Strong communities tend to lead to better project sustainability.

Diversification Strategies

Investing in DACs requires careful planning. Diversifying investments within this space can mitigate risks. One strategy is to invest across multiple DAC projects. This approach spreads risk and increases the chance of returns from successful ventures.

Another method is to consider different sectors within DACs. For example, one might invest in a DAC focused on renewable energy while also supporting a DAC in healthcare innovation. This diversification helps balance potential losses in one area with gains in another.

Investors can also look at different stages of DAC development. Early-stage projects may offer higher returns but come with greater risks. More established DACs may provide stability but potentially lower returns.

The Role of DACs in Innovation

Decentralized Collaboration

DACs promote decentralized collaboration among creators. This structure allows individuals to contribute ideas and resources without traditional hierarchies. Each participant can share their expertise. This leads to faster problem-solving and innovation.

For instance, in 2021, a DAC focused on renewable energy gathered experts from various fields. They developed new technologies for solar panels. Their collaborative efforts resulted in more efficient designs. This example shows how collective creativity drives progress.

Technological Advancements

Specific sectors benefit greatly from DACs. The healthcare industry is one of them. DACs enable researchers to share data securely. This accelerates drug development processes. In 2020, a DAC helped identify potential COVID-19 treatments through shared research.

Another sector is finance. Blockchain-based DACs create transparent financial systems. They allow creators to build decentralized applications (dApps). These applications offer innovative solutions like peer-to-peer lending and smart contracts.

Disruption of Traditional Industries

DACs have the potential to disrupt traditional industries significantly. Many conventional businesses rely on centralized decision-making. This limits innovation and responsiveness to market changes.

In contrast, DACs operate with flexibility. They adapt quickly to new trends and consumer demands. For example, the entertainment industry sees a shift due to DACs. Creators can fund projects directly through crowdfunding platforms without intermediaries.

This change empowers independent filmmakers and musicians. They can reach audiences directly, bypassing traditional studios and labels. As a result, unique content emerges, benefiting both creators and consumers.

New Market Opportunities

DACs create new market opportunities as well. By lowering entry barriers, they invite diverse participants into various sectors. Anyone with a good idea can join a DAC and seek funding or support.

Consider the gaming industry. DACs allow game developers to test ideas directly with players. Players can provide feedback early in the development process. This leads to better games that meet user expectations.

Agriculture benefits from DAC innovation too. Farmers can collaborate through DACs to share resources and knowledge about sustainable practices. This not only improves crop yields but also promotes environmental responsibility.

Future Trends and Predictions

Regulatory Developments

Future regulations will shape the landscape of decentralized autonomous corporations (DACs). Governments may introduce proposals that clarify how DACs operate. These discussions could lead to new laws addressing funding, decision-making, and participant rights within DACs.

In 2023, the European Union proposed a regulatory framework for blockchain technology. This framework aims to provide clarity on digital entrepreneurship. Similar moves in other regions may follow. Such regulations can either support or hinder the growth of DACs. Clear guidelines will encourage investment and participation in these organizations.

Technology Integration

Technology will play a crucial role in the evolution of DACs. Enhanced blockchain solutions will improve transparency and security. Participants can trust that their contributions are recorded accurately. Smart contracts will automate many processes, reducing the need for intermediaries.

As technology advances, DACs may integrate artificial intelligence (AI) and machine learning. These tools can analyze data to optimize decision-making. With better data analysis, traders can make informed choices about investments and resources. This integration will also enhance collaboration among participants.

Investment Dynamics

The future of DACs will attract diverse investors. Traditional venture capitalists may enter this space alongside digital entrepreneurs. The potential for high rewards is appealing but comes with risks. Investors must weigh these factors carefully before committing funds.

Crowdfunding models are likely to gain traction within DACs. These models allow many participants to pool resources for projects. This approach democratizes access to investment opportunities and encourages community involvement.

Evolving Business Models

Business models within DACs will continue to evolve. New approaches may emerge as participants adapt to changing market conditions. Flexibility in operations can lead to innovative solutions for pressing challenges.

For instance, some DACs may focus on social impact projects, aligning profit motives with community needs. Others might prioritize sustainability, attracting environmentally conscious investors. The destiny of each DAC will depend on its goals and the consensus reached by its members.

Pensées de Clôture

Decentralized Autonomous Corporations (DACs) are reshaping the future of business. They offer innovative governance models and investment opportunities that can redefine how companies operate. Understanding their benefits and challenges is crucial for anyone looking to invest smartly in this evolving landscape. Real-world examples show that DACs can drive innovation and provide substantial returns.

Now is the time to dive into DACs. Explore their potential and consider how they fit into your investment strategy. Stay informed, stay engaged, and be part of this exciting shift in business. Your future investments could benefit greatly from understanding and leveraging DACs.

Frequently Asked Questions

What are Decentralized Autonomous Corporations (DACs)?

DACs are organizations that operate through smart contracts on a blockchain. They automate decision-making and management without centralized control, enabling transparency and efficiency.

How do DACs differ from traditional corporations?

Unlike traditional corporations, DACs use decentralized governance models. Decision-making is shared among stakeholders, reducing bureaucracy and increasing responsiveness to market changes.

What are the benefits of investing in DACs?

Investing in DACs offers potential for high returns due to their innovative structures. They promote transparency, reduce operational costs, and can quickly adapt to market demands.

What challenges do DACs face?

DACs encounter regulatory uncertainty, technological risks, and governance issues. These challenges can impact their stability and adoption in the broader market.

How is governance structured in DACs?

Governance in DACs is typically decentralized. Stakeholders participate in decision-making through voting mechanisms embedded in smart contracts, ensuring collective input and accountability.

Can you provide examples of successful DACs?

Notable examples include MakerDAO and Aragon. These DACs have successfully implemented decentralized governance models while providing valuable services within the blockchain ecosystem.

What future trends should investors watch regarding DACs?

Future trends include increased regulatory clarity, integration with traditional finance, and advancements in technology. These developments may enhance the viability and attractiveness of DAC investments.

Send Buck a voice message!

Send Buck a voice message!