Opportunity Zones and QSBS: Unlocking Tax Benefits for Long-Term Investors

Key Takeaways

- Opportunity Zones are low-income areas that have been certified by the U.S. They promote participants’ operations by fostering local economic development through tax incentives that draw new investments and invigorate communities.

- Qualified Small Business Stock (QSBS) also provides investors with significant tax shelters for long-term capital gains. This type of support is crucial for small businesses, the backbone of the U.S. economy.

- If you invest in Opportunity Zones, you can defer capital gains taxes. This strategy offers tremendous fiscal advantages, including a possible step-up basis and permanent gains exclusion after holding the investment for more than ten years.

- QSBS provides for exclusion of long-term capital gains from taxation. Cumulative gain limits can influence investment decisions, highlighting the importance of strategic planning to ensure optimal benefits.

- When you combine QSBS and Opportunity Zone investments, you really double down on the tax benefits. To realize superior returns, do your homework and align your investment objectives with thoughtful purpose.

- Opportunistic investors should work with tax specialists to identify the best eligible investments. When combined, they can help ensure compliance and maximize long-term capital gains, resulting in substantial fiscal benefits when managed diligently.

Opportunity zones and QSBS (Qualified Small Business Stock) really are two of the most powerful tax shelters for long-term gains. These tools provide powerful, complementary benefits to investors looking for tax-efficient strategies.

Opportunity zones offer tax breaks on investments made in specific low-income areas to encourage development. QSBS provides investors an incredible opportunity. When they hold small business stocks for more than five years, they can exclude their profits from federal taxation.

These options give investors powerful tools to achieve greater returns, all while playing a critical role in America’s economic resurgence. Navigating these opportunities requires understanding very specific criteria and regulations.

In doing so, they can greatly improve their portfolios and help foster the growth of new, innovative businesses. Looking deeper into opportunity zones and QSBS shows how powerful these tools can be for advancing individual and community wealth.

What Are Opportunity Zones

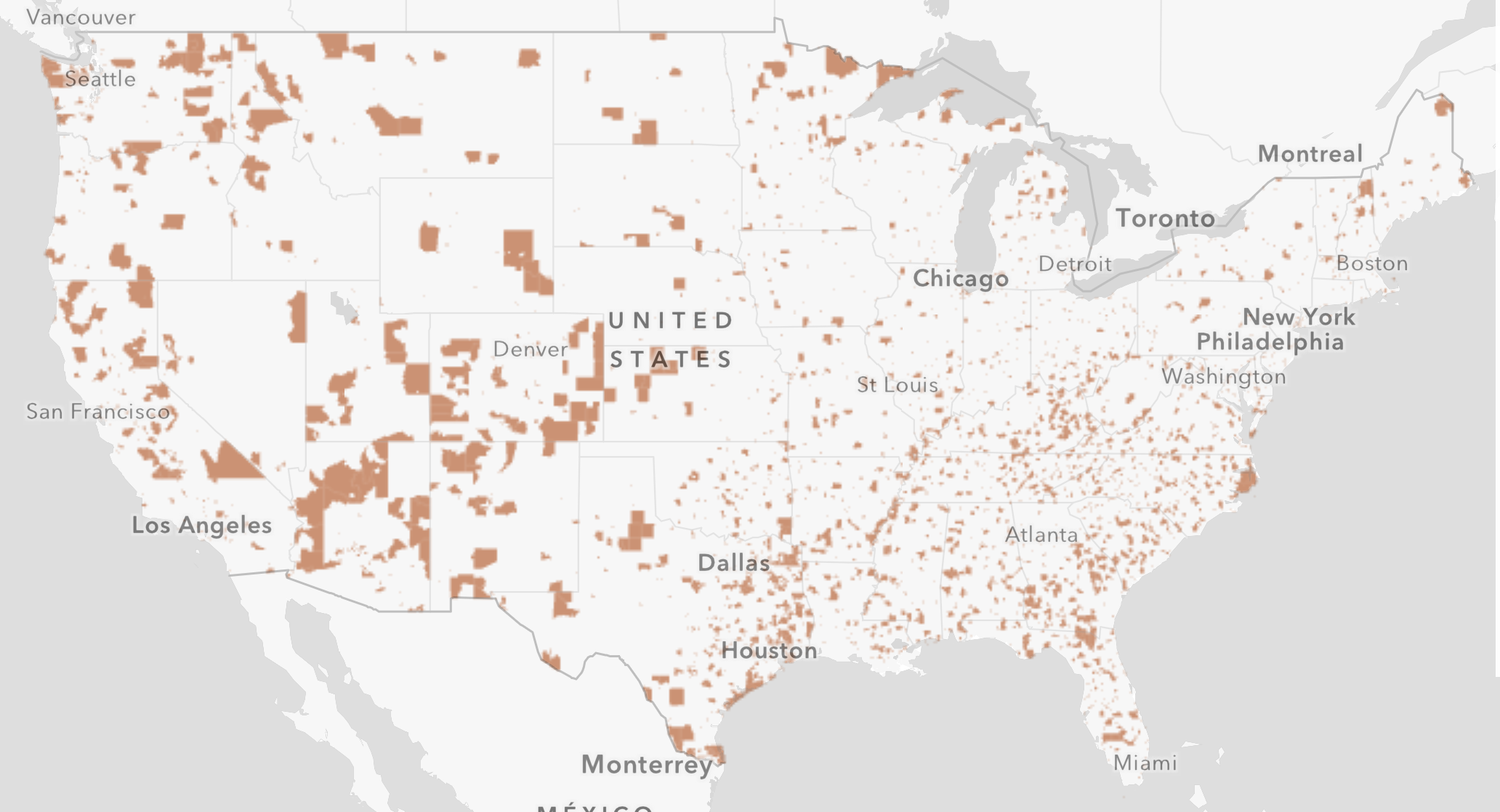

Opportunity Zones are designated economically distressed areas that qualify for special federal tax incentives. These zones are selected by state governments and then formally certified by the U.S. Treasury. This program that launched on April 9, 2018, offered a unique and powerful opportunity for investment in America’s most distressed neighborhoods.

Second, Opportunity Zones are incredibly popular, getting bipartisan support across all 50 states, Washington D.C., and U.S. Territories. This diversity provides investors with a wide range of neighborhoods to invest in.

Definition of Opportunity Zones

Opportunity Zones are low-income areas that the U.S. Government has designated to promote economic development. States nominate these zones, which then get certified by the U.S. Treasury. The creation of this program ushered in a new age of investment starting on April 9, 2018.

These zones cover almost every corner of the United States. They include all 50 states, Washington D.C., and all U.S. Territories, making it one of the most nationwide initiatives ever conceived.

Purpose and Objectives

The original purpose of Opportunity Zones was to encourage new economic investment in communities that have struggled the most. In return for committing their capital to these communities, investors receive powerful tax incentives that play a key role in strengthening local economies.

This initiative promotes economic investment and job creation. It also does so in a way that revitalizes communities, which has a much larger positive impact.

How They Function

Investors in Opportunity Zones profit from tax incentive opportunities that significantly lower their capital gains tax liability. Qualified Opportunity Funds (QOFs) are the linchpin here, because they are the vehicles that are intended to direct these investments into the designated opportunity zones.

Investors need to adhere to strict timelines and other requirements to be eligible for the tax benefits. This new focus results in long-term investments that are mutually beneficial to the investor and the community.

What Is QSBS

When considering tax-advantaged investment vehicles, look closely at Qualified Small Business Stock (QSBS). It shines as perhaps the best option for investors seeking tax-free long-term capital gains. QSBS provides a unique opportunity to minimize capital gains taxes.

Most importantly, it attracts the kind of investors whom lawmakers want supporting small businesses that drive the U.S. Economy. By issuing qualified stock in accordance with IRS guidelines, these businesses provide investors opportunities to realize significant tax benefits.

Definition of QSBS

QSBS must be issued by a QSBS qualified small business, as defined by strict IRS guidelines. A key requirement to benefit from QSBS is to hold the stock for a minimum of five years. This holding period is crucial because it opens the door to various tax benefits.

To qualify, stock must meet standards outlined in the Internal Revenue Code, ensuring it is held under a structure that supports small business growth and innovation.

Eligibility Criteria

To qualify as a small business, a company must meet various requirements, including gross asset limits and definitions of qualifying businesses. Continuous active business operations are crucial for maintaining QSBS eligibility, which offers significant tax advantages and strengthens the connection between investment and economic contribution.

Tax Benefits of QSBS

The tax breaks related to QSBS are massive, with capital gains exclusions as one of the major perks. Long-term holders may exclude up to 100% of gains from federal income taxation, providing significant tax savings.

This exclusion applies to QSBS acquired after September 27, 2010. It provides exemptions from both AMT and NII tax, which combined with the capital gains exemption, render this investment extremely attractive to investors.

Requirements for Opportunity Zones

Investor Eligibility

If you’re someone who wants to learn more about Opportunity Zones, you have to understand who the investor can be. Both people and organizations, such as corporations or partnerships, are eligible. Timing is everything. Taking advantage of these new tools requires strategic thinking.

Investors must move quickly in order to maximize tax benefits. Accredited investors are essential to financing these zones. They often have a very high income level or net worth that excludes them from receiving this investment vehicle. Their financial clout can help catalyze projects that not only fill gaps but build up communities and jumpstart job creating economic development.

Investment Criteria

In exchange for these investments, they need to meet certain requirements in order to unlock tax incentives. The eligible investments have largely been focused on real estate developments or businesses that set up shop within the newly designated Opportunity Zones.

We know it’s important that new capital be directed to these Qualified Opportunity Funds (QOFs). These funds funnel investment dollars straight into the zones, igniting sustainable economic growth and opportunity. By making investments in qualifying properties or businesses located within these designated areas, investors stimulate the economy of these communities.

It fosters economic opportunity and community development.

Compliance and Reporting

For anyone with a stake in Opportunity Zones, maintaining compliance is key. Investors are required to meet certain criteria in order to continue qualifying for tax incentives. Reporting gains and investments requires careful documentation.

The more detailed forms, such as Form 8996 and others, are required for tax reporting purposes. These new forms would help to track how these investments are made, and where, and shine a light on the process to promote transparency and accountability.

Requirements for QSBS

Business Eligibility

To qualify as a QSBS, businesses must meet several requirements. First, they need to be a domestic C corporation, further underscoring the importance of U.S.-based operations. This requirement helps ensure that the business is based on a deep commitment to domestic, active economic endeavors.

For a company to qualify under the law, their businesses must be in areas that directly promote economic development, thereby excluding industries such as finance, mining, or hospitality. Eligible businesses cannot have gross assets over $50 million at the time of stock issuance. This limit is key to their qualification.

Stock Holding Period

The holding period of the stock is very important to receiving QSBS tax benefits. To benefit from tax exclusions under Section 1202, investors need to hold the stock for a minimum of five years. This holding period begins on the date the stock is issued, and in the case of stock options, it begins upon the exercise of the option.

Selling QSBS before the five-year mark will make you lose these valuable tax benefits. If that’s the case, your appreciated gains will be ineligible for the exclusion. This requirement is intended to foster long-term investment in small qualified businesses.

Compliance and Documentation

QSBS claims are a labyrinthine process that requires extreme diligence and documentation. To ensure compliance, investors and issuers should maintain thorough documentation of stock issuance dates and other qualifying transactions. This means counting each issuance individually, even for options that provide a vesting period.

Keeping good records helps prove claims on tax returns, protecting eligibility for QSBS benefits.

Benefits of Investing in Opportunity Zones

Investing in Opportunity Zones offers attractive tax incentives that significantly enhance long-term growth strategies. The federal government has designated these areas to stimulate economic development, providing impactful tax incentives that attract investors eager to deploy their capital in historically underserved communities, ultimately fostering sustainable growth and offering lucrative tax benefits for those involved.

Capital Gains Deferral

Capital gains deferral becomes one of the most important incentives in Opportunity Zones. Specifically, investors can defer taxes on their original gains by rolling them into Qualified Opportunity Funds (QOFs). They will owe tax only when they sell or otherwise exchange the investment, or by December 31, 2026 – whichever is earlier.

This deferral provides for investors a unique strategic advantage. They get to reinvest the capital gains tax payments they would have made on the gains into new opportunities, juicing their returns overall.

Step-Up in Basis

One of the major tax benefits tied to Opportunity Zones is the step-up in basis. Longer is better (and all the rage). Hold your investments in Opportunity Zones for a minimum of five years. You can step up your original basis in the deferred gain by 10%!

Holding for seven years raises this increase to 15%. This change means the taxable gain is effectively reduced when the investor eventually sells their investment, providing significant long-term value.

Permanent Exclusion of Gains

When investments are held for a minimum of ten years, investors can enjoy a permanent exclusion of gains from taxation. This benefit means you can receive any appreciation in the investment’s value over a decade without paying capital gains tax on it.

You can really cash in on that appreciation! This meaningful benefit can deeply affect an investor’s opportunistic approach, motivating investments for the long haul and yielding the greatest capital appreciation.

Benefits of Holding QSBS

Tax-Free Gain Exclusion

QSBS provides a tax-free gain exclusion for those who hold qualified small businesses stock long term. If you hold QSBS for more than five years, you can potentially save millions on taxes. This may save you the capital gains tax on up to $4.4 million in gains.

With the potential to save up to 14% on gains, this tax break is an appealing opportunity for investors looking to get the most out of their returns. Mastering QSBS tax rules is key to maximizing smart financial planning. It helps you keep more of the profits you work so hard for.

This exemption can be a huge boon to entrepreneurs and their VC backers. It gives them a special leg up in today’s hyper-competitive investment climate.

Cumulative Gain Limits

Cumulative gain limits are an important factor in QSBS tax treatment applicability. These limits can have a huge impact on your investment decisions, especially how much in tax-free gains you’re eligible to receive.

Strategic planning is critical in order to maximize QSBS benefits, making sure you target your investments within these restrictions. Knowing how far you can invest without exceeding limits gives you the power to invest strategically.

This, in turn, increases your cash flow and helps your business grow.

Long-Term Growth Potential

When made wisely, QSBS investments are an excellent opportunity for long-term growth. Because small businesses create the majority of new economic innovation, investing in the next big thing through QSBS can help create new avenues of wealth.

Beyond that, it offers you peace of mind, so you can make long-term plans with confidence. With 45.4% planning to make multiple investments in 2024, interest in QSBS remains strong, highlighting its potential to achieve long-term financial goals.

How to Combine QSBS and Opportunity Zones

Combining QSBS with Opportunity Zones provides investors with a truly powerful strategy. This strategy is designed to allow them to maximize their tax benefits. First, targeting the right eligible investments is key. A transparent set of criteria makes it easier to identify and select investments that would qualify for both QSBS and Opportunity Zones.

Going through some robust due diligence is key to making sure that any investment complies with these criteria. Enlisting tax professionals can be crucial in identifying eligible opportunities and ensuring investors make smart decisions.

1. Identify Eligible Investments

When sourcing qualified investments, look for opportunities that satisfy the criteria of both QSBS and Opportunity Zones. This necessitates a close examination of the nature and location of the business and its ongoing compliance with very specific regulations.

Due diligence is vital, as it identifies red flags and verifies compliance. Tax professionals are key to making that happen. They offer helpful guidance, making sure all criteria is satisfied, going a long way in ensuring maximum benefits.

2. Align Investment Strategies

It starts with knowing the unique benefits each provides. Where QSBS provides exclusion from capital gains tax, Opportunity Zones offer deferral and potential elimination of capital gains tax.

By strategically aligning these investments, investors can maximize returns and make the most of the unique benefits of each.

3. Maximize Tax Deferrals

To fully realize tax deferrals, careful timing of investments will be required. Investors should be mindful of the holding period requirements and when gains are realized.

Ongoing tracking and analysis helps make sure that the investments are doing what they should and staying on track to qualify for substantial tax breaks. Taking a proactive approach goes a long way in ensuring compliance and the best possible outcomes.

4. Optimize Long-Term Gains

To truly maximize long-term gains, strategy and thoughtful approach to compliance, investment, and management will be essential. Keeping abreast of changes to tax regulations helps you maintain eligibility.

With the combination of effective investments administration and the potential for huge financial rewards, it is effort well spent.

Conclusion

Getting into Opportunity Zones and QSBS unveils a treasure chest of benefits for investors looking for long-term returns. You access significant tax savings and economic growth by making thoughtful investments. These two tax shelters provide unique opportunities to build personal wealth while contributing to community revitalization efforts. In isolation, they are not the holy grail, but combined they both are powerful tools in a smart investment strategy. Together, these two tax advantages create an enormous wealth-building potential. By staying informed and proactive, you can leverage these opportunities to do great things. Double click here to begin typing your message. → Ready to take your next step? Learn more about how Opportunity Zones and QSBS can help you achieve your long-term financial dreams. Meet with experts or go further into the materials to learn what needs to happen and how best to continue making progress. We hope your adventure in building wealth for yourself and your community begins today.

Frequently Asked Questions

What Are Opportunity Zones?

Opportunity Zones are a type of economically-distressed area designated by the government, where investors can benefit from attractive tax incentives, significantly improving long-term economic conditions and enhancing their overall investment strategy.

What Is QSBS?

Qualified Small Business Stock (QSBS) provides individual investors with significant tax advantages, allowing them to exclude their capital gains from federal income tax purposes if held for more than five years.

What Are the Requirements for Opportunity Zones?

To reap the impactful tax incentives of project financing, investors must reinvest eligible capital gains into a Qualified Opportunity Fund within 180 days. For significant tax advantages, the investment should be held for at least 10 years.

What Are the Requirements for QSBS?

To qualify for the significant tax advantages of qualified small business stock (QSBS), the business must be a C corporation with assets less than $50 million at the time of stock issuance, and the investor must hold the stock for more than five years.

What Are the Benefits of Investing in Opportunity Zones?

Investors can defer and reduce their capital gains taxes, particularly through significant tax advantages like the permanent exclusion of gains on investments made in Opportunity Zones, which can be particularly impactful for qualified small business stock.

What Are the Benefits of Holding QSBS?

Investors can exclude up to 100% of their qsbs gains from federal income tax purposes. To qualify, they need to meet the holding period and other detailed requirements.

Send Buck a voice message!

Send Buck a voice message!