Unlocking the Potential of Private Equity Co-Investments: A Guide to Partnering for Success

Key Takeaways

- Private equity co-investments allow investors to directly invest with these lead firms, reaping outsized returns while shouldering some of the risks. This strategy bypasses traditional fund constructs. It opens up exclusive, direct investment opportunities and opens access to higher-growth companies that typical funds cannot provide.

- Co-investments provide powerful outsized returns by giving investors the opportunity to invest directly alongside their managers in more attractive companies or assets. For instance, it is very important for co-investors to know the terms and conditions that are provided to lead investors.

- By teaming up with institutional investors you gain access to larger pools of capital. Their credibility and track record provides private equity partners with additional deal sourcing and negotiation power, establishing mutually beneficial long-term relationships.

- Institutional partners offer comprehensive due diligence processes, benefitting co-investors through shared research and analysis. This includes thorough evaluations of financial health, market positioning, and leveraging institutional expertise for informed decisions.

- Co-investors benefit from lower cost and lower fees relative to traditional private equity funds. This strategy is beneficial to their overall investment returns. Partnerships and strategic alignment with institutions can help bolster deal flow and investment opportunities.

- Co-investments aren’t without their challenges, however. Investors are stuck with little recourse if bad decisions are made, challenges in aligning with other investors, and the potential for conflicts of interest. Effective communication and alignment around investment theses go a long way toward addressing these challenges.

Private equity co-investments represent a real opportunity on the road to outsized returns through partnerships with seasoned institutions. The strategy allows investors to partner directly with private equity firms. Along the way, they’ll get access to these exclusive deals all while benefiting from the expertise and resources of these seasoned partners.

Co-investments are typically offered at lower fees with more favorable terms. This narrative makes them an attractive option for investors looking to enhance their investment returns. Savvy investors can greatly enhance their decision-making ability by working alongside these institutional partners.

This collaboration gives them access to deep industry expertise and strategic direction. Private equity co-investments put a premium on collaboration and alignment of interests. For one, they present a terrific opportunity for those looking to invest and dramatically increase their financial returns.

What Are Private Equity Co-Investments

Definition and Overview

Co-investments are direct investments made alongside another firm, usually the lead firm, and often consisting of minority stakes in businesses. By doing so, investors can create incentives that align their interests with those of lead investors.

Due to the highly collaborative nature of co-investing, several investors join a single deal, allowing them to share the risks and the reward. By investing directly, participants can achieve improved returns by backing the most promising companies or assets.

Co-investors need a full understanding of the terms and conditions that will be provided to lead investors. This mutual understanding is what equips them to be clear and effective partners.

This understanding allows for proper structuring of the partnership and can prevent unintended legal liability with respect to equity and asset ownership.

Typical Structure and Mechanisms

GPs & LPs have very different roles. Because co-investors take on the same risks and rewards as the lead investors, this type of structure encourages alignment on investment strategy.

Private equity co-investments Partnership agreements and investment vehicles are the machinery that make these deals possible. Transparency and communication are key in the co-investment process, helping to build a strong, successful partnership.

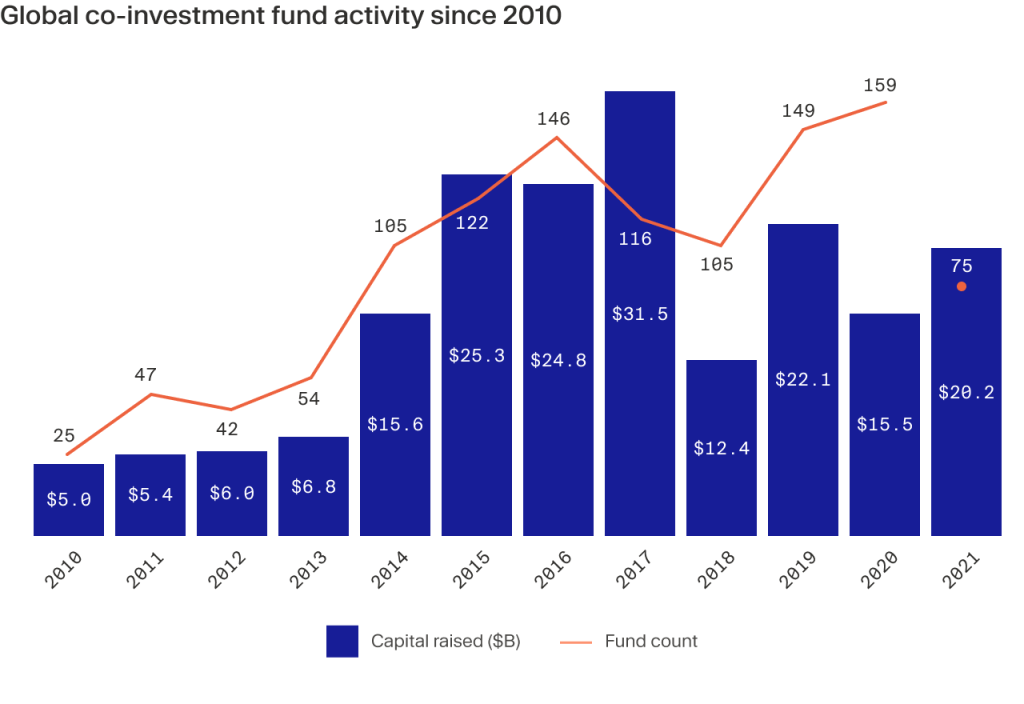

LPs need to listen to the terms of their involvement, including the ability to withdraw and the payout terms after a buyout or IPO takes place. Co-investments experienced an incredible boom, increasing demand from $4 billion in 2010 to $10.3 billion in 2022.

This impressive growth is a testament to their resilience in tough markets. Though providing access to differentiated opportunities, co-investments can be burdensome, demanding significant time and resources to competently process.

LPs need to understand risks including illiquidity and possibility of greater losses, getting them to make better decisions. ICapital Markets LLC is fueled by high transaction volumes created by co-investments.

Its success underscores the value of strategic private-public partnerships and the powerful influence of market dynamics.

Benefits of Partnering with Institutions

The benefits of partnering with institutional investors are manifold, creating co-investment opportunities that are extremely attractive to institutions. Perhaps the biggest benefit is access to deeper pools of capital. Institutions bring deep pockets of financial capital.

This power gives co-investors the chance to participate in larger and more lucrative deals than they are able to do alone. This access gives them not only first dibs on the kind of exclusive transactions that get all the headlines but a broader competitive advantage in the market.

Having institutional partners at the table adds credibility and expertise. These organizations are extremely qualified experts with extensive understanding and experience in investment strategies. Their participation in a co-investment increases the perceived value and credibility of the opportunity.

This, in turn, attracts more public and private interest and resources. The trust and reputation they maintain within the financial community can be instrumental in cutting through the investment fog.

Deals

Every institutional partnership greatly increases your sourcing capability and power in negotiations. For one, institutions obviously have deeper institutional networks and connections to tap into access a wider variety of investment opportunities.

This network effect increases the ability of co-investors to access deals that are otherwise inaccessible. Institutional partners wield incredibly powerful negotiating skills. This can help them negotiate more favorable terms and conditions, ultimately maximizing taxpayers’ return on investment.

The promise of lasting relationships is yet another attractive reason to work with institutions. These collaborations frequently grow into long-lasting partnerships, creating pathways toward future investment prospects.

When you work with these partners, you can help foster a collaborative environment. This creates an environment of joint learning and growth, resulting in more financially rewarding opportunities.

Access to Exclusive Opportunities

- High-profile real estate developments

- Large-scale infrastructure projects

- Tech company buyouts

- Renewable energy investments

Through these direct investments, co-investors gain access to high-value transactions not made available to the public. Such access provides a competitive edge and presents unique market opportunities.

Engaging in these transactions can go a long way in dramatically improving overall portfolio performance.

Enhanced Due Diligence

Institutional partners can be critical in this regard, providing extensive, rigorous processes for due diligence. Co-investors benefit by having the backstop of shared research and analysis, learning from the research of experienced institutions.

Complements evaluations of financial health and market positioning are important. Co-investors would do well to tap into this expertise to make smarter investment decisions.

Risk Mitigation Strategies

Institutions employ risk mitigation techniques to protect capital. Diversified portfolios reduce overall risk exposure. Thorough market assessments identify potential pitfalls.

Co-investors should align their risk tolerance with institutional strategies.

Potential for Outsized Returns

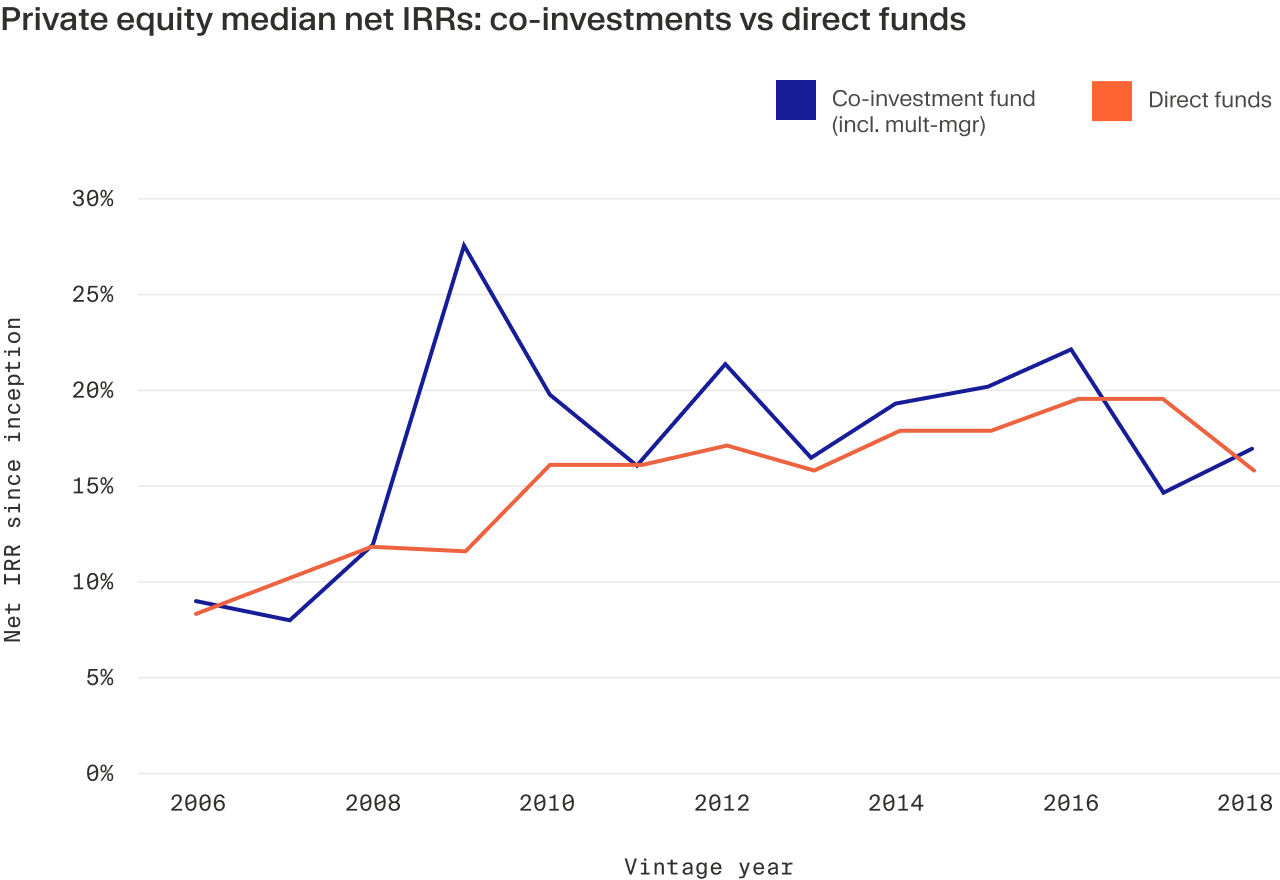

Private equity co-investments present an exceptional opportunity to earn outsized returns. This occurs largely because you are able to bypass middleman costs. In traditional private equity fund models, these fees usually accrue in the form of a 1.5-2% management fee plus a 20% carried interest.

More of their returns stay with co-investors, improving net returns. Beyond their experience, partnering with seasoned institutional investors brings strategic advantages. Institutions often get in on attractive opportunities that retail investors miss out on.

This head start increases their odds of producing successful exits, such as IPOs or strategic acquisitions. According to a 2023 study by Goldman Sachs, 51% of limited partners think they are under-allocated in co-investments. This new finding shines a light on an increasing movement to pursue these investment opportunities.

1. Leveraging Institutional Expertise

Beyond the co-investment process, partnering with established investment teams provides you with crucial investment insights. Our institutional partners offer incredible mentorship and programmatic guidance.

This targeted support arms these co-investors with deep expertise, equipping them with the tools to overcome challenging market dynamics. The ability to save on special offers only available to members, smart and rigorous due diligence, and strategic mentorship further enhance the value of these partnerships.

2. Diversification Benefits

Co-investments offer a further diversified portfolio, across many different asset classes. This strategy lowers the risk associated with single assets.

This access fuels investment across sectors and stages of the business lifecycle. Such diversification is essential in realizing optimal risk-return balances, placing co-investments as a key strategic option for investors.

3. Cost Efficiency and Fee Reduction

Co-investments have significant cost benefits compared to investing directly in a traditional private equity fund. With lower management fees comes higher net returns, and fee transparency is often improved under these structures.

Direct investments eliminate the need for carried interest, translating into millions of dollars in financial benefits. This cost efficiency is a compelling reason for investors to consider co-investments as part of their strategy.

4. Strategic Alignment with Institutions

Matching investment objectives with institutional partners makes sure that everybody’s getting what they want. Having shared objectives helps to create a climate for better decision-making and collaboration.

Strategic partnerships increase deal flow and investment opportunities, and daily or active engagement with such partners helps keep everyone aligned and engaged. This alignment is crucial for maximizing the potential of co-investments.

Challenges in Private Equity Co-Investments

Limited Control and Influence

As co-investors, LPs are frequently put into situations where they have no real power to affect the day-to-day management of businesses owned by portfolio companies. Moreover, minority stakes usually have little, if any, governance control rights. Therefore, they often do not have the authority to shape strategic direction.

Knowing these challenges is important for co-investors because it helps calibrate realistic expectations as to what their participation will look like. Co-investors are typically used to performing quarterly valuations and analyzing financial statements. Unlike the public equity holders, they generally don’t get to vote on the operations in the day-to-day.

To avoid this trap, when entering a co-investment, co-investors should set clear expectations from the start about how much they want to be involved.

Complexity in Coordination

Logistically, managing multiple co-investors in a single investment deal can be a challenge. Building good communication channels is key to ensuring that everyone is aligned in the investment relationship. Comprehensive partnership structures can provide clear guidance on roles and responsibilities, helping to avoid confusion and misunderstandings.

A clear process for coordination can greatly accelerate decision-making, which is critical when co-investors need to forecast future needs for follow-on fund investments. Transparent communication helps avoid miscommunication and keeps the co-investment process working effectively, especially in the complex investment landscape that can evolve in these situations.

This is even more critical when considering the sometimes elaborate structures that can evolve in co-investment situations.

Potential Conflicts of Interest

Conflicting interests between co-investors and lead private equity firms can pose significant challenges. Private equity’s golden age comes at a cost. Only through transparency can we start to root out these conflicts before they turn into something more pernicious.

Co-investors need to set rules for amicably working through disagreements and have continuous dialogue to keep the relationship fueled by trust. Incomplete or unclear partnership structures can result in serious legal ramifications over equity/asset ownership.

By establishing clear, transparent guidelines, co-investors can limit these risks and build healthier collaborations. This proactive approach not only prevents potential strains in LP-GP relations but fosters a positive investment ecosystem.

Strategies for Successful Co-Investments

Establish Clear Objectives

We’ve found that establishing clear, measurable outcomes is the most important aspect of co-investment collaborations. A key strategy for successful co-investments is for co-investors to articulate their precise investment objectives from the beginning, so they match those of their institutional co-investors.

This alignment leads to a clear and focused strategy that drives decision making across the entire investment process. Ongoing evaluation of these objectives helps investors pivot as market conditions change, keeping the investor on track and staying true to their objectives and strategy.

Conduct Thorough Research

Thorough research is a cornerstone of successful co-investments. Conducting comprehensive due diligence is essential, involving the evaluation of financial, market, and management aspects of potential investments.

Institutional partners play a pivotal role by providing valuable research resources. Staying informed about market trends and emerging opportunities is key for co-investors, equipping them with insights to make informed decisions.

Develop Strong Partnerships

Cultivating strong relationships with institutional co-investment partners is critical to achieving lasting success. These relationships are built on a foundation of trust and mutual respect, creating an atmosphere for a collaborative investment environment.

Through expanded networking and collaboration across the private equity landscape, everyone can reap the rewards, building opportunity and success for all. Building strong relationships and being an active, engaged partner builds strong relationships among the co-investors, providing a foundation for achieving successful outcomes.

Key Strategies for Co-Investment Success

- Define investment objectives clearly and regularly review them.

- Conduct exhaustive research and due diligence.

- Cultivate strong, collaborative relationships with partners.

- Negotiate rights for decision-making and board representation.

- Stay informed about market trends and opportunities.

- Ensure regular financial reporting and oversight mechanisms.

Conclusion

Private equity co-investments provide an incredible opportunity to enhance your potential economic returns. By partnering with institutions, investors are able to leverage their expertise and resources. This alliance offers a compelling, aligned route to outsized returns. For investors looking for growth, it’s a very appealing investment. They reap rewards like access to proprietary deals and better leverage in negotiations.

Though there are challenges, including figuring out complex structures and higher risks, the possible rewards are huge. With smart, market-informed strategies, we can and will succeed in this brave new world. It’s more about the learning, evolving, and then figuring out how to use those partnerships to your advantage.

Want to learn more about private equity co-investments. Now’s the time to seize these opportunities, capitalize on your competitive advantages, and prepare for the journey to outsized returns.

Frequently Asked Questions

What are private equity co-investments?

Private equity co-investments are direct investments made in parallel with a private equity fund investment, allowing individual investors to partner with institutions. This collaborative approach provides a unique investment opportunity to access specific deals without committing to the entire fund structure.

Why partner with institutions for co-investments?

Furthermore, partnering with institutions offers individual investors access to more exclusive investment deals. These institutions bring collective expertise, extensive due diligence, and large-scale investment opportunities to the table that individual private investors may not be able to access on their own.

How can co-investments lead to outsized returns?

The best co-investments are in high-potential, emerging companies. By avoiding the drag of fund management fees and gaining entry to premium investment deals, individual investors can earn outsized returns compared to investing in a traditional fund structure.

What challenges exist in private equity co-investments?

Challenges such as limited available deal flow, intense competition, and the need for detailed due diligence can make this investment landscape daunting for investors. They encounter potential conflicts of interest and must have sufficient investor capital to make the investment opportunity worthwhile.

What strategies ensure successful co-investments?

To maximize chances of success in the investment landscape, do the hard work of rigorous due diligence, align with proven, experienced partners, and diversify your co-investment portfolio with various asset classes. Leverage institutional expertise and keep communication transparent to avoid undue risks.

Are co-investments suitable for all investors?

These types of co-investments are best suited for experienced investors, particularly those with substantial investor capital to deploy. They necessitate a deep commitment to the investment landscape, extensive due diligence, and an appetite to take on greater risk.

How do co-investments differ from traditional private equity investments?

Co-investments are direct stakes in specific investment deals, allowing individual investors to bypass fund-level fees. While traditional fund structures offer wider diversification, they often yield lower potential returns for investor capital.

Send Buck a voice message!

Send Buck a voice message!